Escrow account software simplifies secure transactions between buyers and sellers. It ensures that funds are held safely until both parties fulfil their obligations.

In today’s digital age, financial security is crucial. Whether you are buying or selling online, trust is essential. Escrow account software acts as a neutral third party, holding the funds until the transaction is complete. This software provides peace of mind by reducing the risk of fraud.

Users can track the progress of their transactions in real-time, ensuring transparency. For businesses and individuals alike, this tool offers a safer way to handle money. Discover how escrow account software can protect your transactions and make your financial dealings smoother and more secure.

What Is Escrow Software

Escrow account software plays a vital role in ensuring secure transactions between buyers and sellers. But what is escrow software, and why is it important? Escrow software is a digital tool that helps manage and automate the process of holding funds or assets in a third-party account until the terms of a transaction are met. It provides a layer of security and trust in various transactions, from real estate deals to online marketplaces.

Purpose Of Escrow Software

Escrow software serves several important purposes that make transactions safer and more efficient:

- Security: It protects the interests of both parties by holding funds or assets until all conditions are satisfied.

- Trust: It builds trust between buyers and sellers by ensuring that funds are only released when agreed-upon conditions are met.

- Automation: It automates the escrow process, reducing the need for manual intervention and minimizing human errors.

- Transparency: It provides a transparent transaction process, where all parties can track the status of the escrow.

The table below outlines the primary purposes of using escrow software in various industries:

| Industry | Purpose |

|---|---|

| Real Estate | Secure deposit handling and property transactions |

| Online Marketplaces | Ensure payment upon delivery of goods/services |

| Freelancing | Guarantee payment for completed projects |

Key Features

Escrow software comes with several key features that enhance its functionality and user experience:

- Multi-Currency Support: Handle transactions in different currencies to cater to global users.

- Automated Notifications: Send alerts and reminders to parties involved in the transaction.

- Dispute Resolution: Provide mechanisms to resolve disputes between buyers and sellers efficiently.

- Customizable Terms: Allow users to set specific conditions and terms for releasing funds or assets.

- Integration Capabilities: Integrate with other financial systems and payment gateways.

These features make escrow software a reliable choice for secure and transparent transactions. The following table highlights some additional features and their benefits:

| Feature | Benefit |

|---|---|

| Secure Payment Gateway | Ensures safe and encrypted transactions |

| Real-Time Tracking | Allows users to monitor transaction progress |

| User-Friendly Interface | Easy to navigate and use for all parties |

By understanding these features, users can make the most out of escrow software, ensuring their transactions are secure and transparent.

Credit: www.turtlesoft.com

Benefits Of Using Escrow Software

Escrow account software provides a secure way to handle transactions between two parties. It holds the funds until all conditions of the sale are met. This ensures both parties fulfil their obligations. Below are some benefits of using escrow software.

Security And Trust

Escrow software enhances security and trust between buyers and sellers. It acts as a neutral third party, holding the funds until the transaction terms are satisfied. Here’s how it builds security and trust:

- Neutrality: The software does not favour either party. It ensures fairness in the transaction.

- Fund Protection: The buyer’s money is safe until the seller fulfils their part of the deal. This protects against fraud.

- Transparency: Both parties can track the transaction status in real time. This transparency reduces doubts and disputes.

- Compliance: The software adheres to legal regulations, ensuring compliance with financial laws. This adds an extra layer of security.

Consider this table highlighting key security features:

| Feature | Description |

|---|---|

| Encryption | Secures data transfer between parties. |

| Authentication | Verifies identities to prevent unauthorized access. |

| Auditing | Keeps a detailed log of all transactions. |

Streamlined Transactions

Escrow software streamlines transactions by automating many processes. This makes the transaction faster and more efficient. Key benefits include:

- Automated Processes: The software automates payment releases, notifications, and updates. This reduces manual work and errors.

- Time-Saving: Transactions are completed quicker because the software handles many steps. This saves valuable time for both parties.

- Cost-Effective: Reducing manual intervention lowers operational costs. This makes the transaction more affordable.

- Ease of Use: The software is user-friendly. It guides users through each step, making the process simple and straightforward.

Here’s a comparison of traditional vs. escrow software transactions:

| Aspect | Traditional Transactions | Escrow Software Transactions |

|---|---|---|

| Speed | Slow, manual process | Fast, automated process |

| Cost | High operational costs | Lower costs due to automation |

| Accuracy | Prone to human errors | Minimized errors through automation |

Types Of Escrow Software

Escrow account software plays a crucial role in safeguarding financial transactions. It ensures both parties meet their obligations. There are different types of escrow software catering to various needs. The main types are Real Estate Escrow and Online Transaction Escrow.

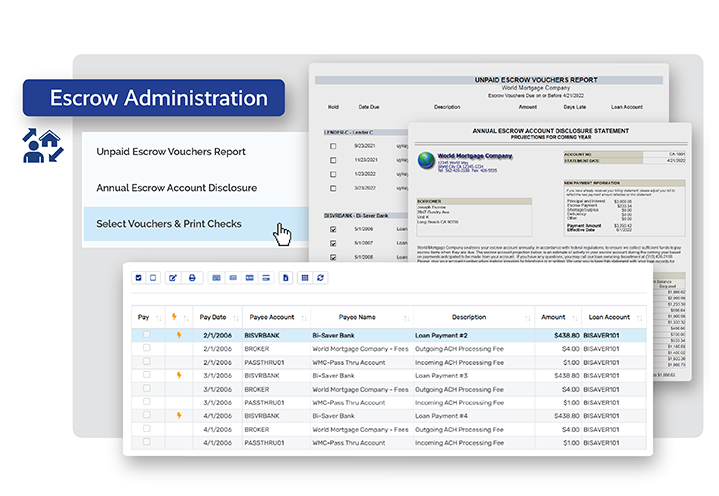

Real Estate Escrow

Real estate escrow software is essential for property transactions. It manages the funds and documents involved in buying or selling a home. This type of software offers several features:

- Automated Payments: Ensures timely payments to all parties.

- Document Management: Stores and shares important documents securely.

- Compliance Tracking: Keeps track of regulatory requirements.

- Transparency: Provides all parties with clear updates on the transaction status.

Such software simplifies the complex process of real estate transactions. It reduces the risk of fraud and errors. Here’s a quick comparison of some popular real estate escrow software:

| Software | Features | Price |

|---|---|---|

| Software A | Automated Payments, Document Management | $50/month |

| Software B | Compliance Tracking, Transparency | $70/month |

| Software C | All Features | $100/month |

Online Transaction Escrow

Online transaction escrow software is vital for digital transactions. It ensures both buyers and sellers fulfil their part of the deal. This type of software includes features like:

- Payment Security: Protects funds until the product or service is delivered.

- Dispute Resolution: Provides a mechanism to resolve conflicts.

- Transaction Tracking: Keeps a record of all transactions.

- Instant Notifications: Alerts users about transaction updates.

Such software is popular among e-commerce platforms and freelance marketplaces. It builds trust between parties who may not know each other. Below is a comparison of some popular online transaction escrow software:

| Software | Features | Price |

|---|---|---|

| Software X | Payment Security, Dispute Resolution | $30/month |

| Software Y | Transaction Tracking, Instant Notifications | $40/month |

| Software Z | All Features | $60/month |

Both types of escrow software provide peace of mind and security. They ensure safe and reliable transactions for all parties involved.

Choosing The Right Software

Choosing the right escrow account software is a critical decision for businesses. The right software ensures secure transactions, compliance, and efficient management of funds. This section will guide you through the key considerations and top providers to help you make an informed choice.

Key Considerations

When selecting escrow account software, several factors should be considered to ensure it meets your business needs:

- Security: The software must provide robust security features to protect sensitive information and funds.

- Compliance: Ensure the software complies with relevant financial regulations and standards.

- User Interface: A user-friendly interface is essential for efficient navigation and operation.

- Integration: The software should seamlessly integrate with your existing systems and tools.

- Support: Reliable customer support is crucial for resolving any issues that may arise.

- Cost: Consider the cost of the software, including any hidden fees or charges.

Here’s a quick comparison table to help you evaluate different escrow account software options:

| Feature | Importance | Comments |

|---|---|---|

| Security | High | Look for encryption and fraud detection |

| Compliance | High | Check for industry certifications |

| User Interface | Medium | Should be easy to use |

| Integration | Medium | Ensure compatibility with current systems |

| Support | High | 24/7 support preferred |

| Cost | Variable | Compare pricing plans |

Top Providers

There are several reputable escrow account software providers in the market. Here are some of the top options:

- Escrow.com: A well-known provider offering a range of escrow services. Known for its strong security measures and compliance with industry standards.

- Payoneer Escrow: Offers escrow services with a focus on international transactions. Integrates well with various payment systems.

- Trustap: Provides a secure escrow service for both buyers and sellers. Features a user-friendly interface and comprehensive customer support.

- Armour Payments: Specializes in B2B transactions. Known for its strong security features and compliance with financial regulations.

- SafeFunds: Offers a straightforward escrow service with transparent pricing. Provides reliable customer support and easy integration with other systems.

Each provider has unique features and benefits. It’s important to assess these based on your specific business needs. Consider factors like security, compliance, support, and cost. Choose a provider that aligns with your requirements for a seamless escrow experience.

Integration With Other Systems

Escrow account software is essential for managing secure transactions between parties. Integration with other systems enhances its functionality. This integration streamlines processes, reduces manual errors, and ensures seamless operations. Let’s explore how it integrates with payment gateways and accounting software.

Payment Gateways

Escrow account software often integrates with various payment gateways. This ensures smooth and secure financial transactions. Here are some benefits:

- Real-time processing: Payments are processed instantly, reducing delays.

- Enhanced security: Payment gateways use encryption and other security measures to protect transaction data.

- Multiple payment options: Customers can use credit cards, debit cards, and other payment methods.

Let’s look at some common payment gateways that integrate with escrow account software:

| Payment Gateway | Features |

|---|---|

| PayPal | Widely used, secure, supports multiple currencies |

| Stripe | Developer-friendly, supports recurring payments |

| Square | Easy setup, suitable for small businesses |

Integration with payment gateways ensures that funds are safely transferred. It also simplifies the payment process for both parties involved.

Accounting Software

Integrating escrow account software with accounting software is crucial. This ensures accurate financial records and simplifies bookkeeping. Here are the advantages:

- Automated entries: Transactions are automatically recorded in the accounting system.

- Reduced errors: Manual data entry errors are minimized.

- Time-saving: Automation saves time on repetitive tasks.

Popular accounting software that can integrate with escrow account software includes:

| Accounting Software | Features |

|---|---|

| Quickbooks | Comprehensive accounting, invoicing, expense tracking |

| Xero | Cloud-based, real-time financial data, easy reconciliation |

| FreshBooks | Time tracking, project management, user-friendly interface |

Integration with accounting software ensures that all financial transactions are accurately tracked. This is vital for auditing and financial reporting. It also makes it easier to manage taxes and financial planning.

Credit: www.themortgageoffice.com

User Experience And Interface

Escrow account software simplifies and secures transactions. The user experience and interface play a crucial role in its effectiveness. A well-designed interface ensures ease of use and efficiency, making it accessible to both tech-savvy users and beginners.

Importance Of Usability

Usability is the cornerstone of any successful escrow account software. Users need to navigate the system with ease. A user-friendly interface reduces the learning curve and minimizes errors. Here are some key aspects of usability:

- Intuitive Navigation: Users should find what they need quickly. Clear menus and logical flow are essential.

- Accessible Design: The software must cater to users with different abilities. Features like screen readers and keyboard navigation help.

- Responsive Layout: A responsive design ensures the software works on various devices. Whether on a desktop, tablet, or smartphone, the experience should be consistent.

- Clear Instructions: Users should understand how to perform tasks without confusion. Tooltips and help sections are beneficial.

Consider the table below illustrating the impact of usability on user satisfaction:

| Usability Factor | Impact on User Satisfaction |

|---|---|

| Intuitive Navigation | High |

| Accessible Design | Medium |

| Responsive Layout | High |

| Clear Instructions | Medium |

Good usability enhances the overall experience. It ensures users can focus on their transactions rather than struggling with the software.

Customization Options

Customization options allow users to tailor the software to their needs. This flexibility is vital for businesses of different sizes and industries. Here are some key customization features:

- Personalized Dashboards: Users can customize their dashboards. This helps them focus on relevant information.

- Configurable Alerts: Users can set alerts for important events. This keeps them informed without constant monitoring.

- Role-Based Access: Different users have different roles. Customizable access levels ensure security and efficiency.

- Integrations: The software should integrate with other tools. This includes accounting software, CRMs, and payment gateways.

Consider the benefits of customization options:

| Customization Option | Benefit |

|---|---|

| Personalized Dashboards | Improved Focus |

| Configurable Alerts | Timely Notifications |

| Role-Based Access | Enhanced Security |

| Integrations | Seamless Workflow |

Customization options ensure the software meets diverse user needs. They enhance the user experience by providing flexibility and control.

Regulatory Compliance

Escrow account software is an essential tool in the digital age. It helps manage funds securely between parties involved in a transaction. One key aspect of this software is regulatory compliance. Ensuring that the software meets legal standards and protects user data is crucial for trust and integrity.

Legal Requirements

Legal requirements for escrow account software ensure that all transactions are lawful and transparent. These laws vary by country and industry, but some common regulations include:

- KYC (Know Your Customer): Verifying the identity of all parties involved in a transaction.

- AML (Anti-Money Laundering): Preventing the software from being used to launder money.

- GDPR (General Data Protection Regulation): Protecting the personal data of users in the European Union.

Failure to comply with these regulations can result in severe penalties. Companies must stay updated with changing laws. Implementing compliance features in the software is essential. This can include:

- Automated identity verification processes

- Regular audits and reporting mechanisms

- Secure and transparent record-keeping

Here is a table summarizing some critical legal requirements:

| Requirement | Description |

|---|---|

| KYC | Verify identities of all parties |

| AML | Prevent money laundering activities |

| GDPR | Protect user data within the EU |

Adhering to these legal requirements builds trust. It also ensures smooth operations and avoids legal issues.

Data Protection

Data protection is another critical aspect of escrow account software. Protecting user data from unauthorized access is paramount. This involves implementing robust security measures. Some of these measures include:

- Encryption: Encrypting data in transit and at rest to prevent unauthorized access.

- Access Controls: Ensuring only authorized personnel can access sensitive data.

- Regular Security Audits: Conducting regular audits to identify and fix vulnerabilities.

Compliance with data protection regulations is essential. For instance, the GDPR requires companies to protect the personal data of EU citizens. Non-compliance can lead to hefty fines and loss of reputation.

Below is a list of steps to enhance data protection:

- Implement strong encryption methods

- Use multi-factor authentication for access

- Conduct regular security training for staff

- Perform frequent security audits

Data protection isn’t just about technology. It also involves creating a culture of security awareness within the organization. Employees must understand the importance of protecting user data. This can be achieved through regular training and clear policies.

Ensuring data protection builds user trust. It also prevents data breaches and legal issues.

Credit: rynoh.com

Future Trends In Escrow Software

Escrow account software is evolving rapidly, driven by technological advancements. Future trends in escrow software promise to enhance security, efficiency, and transparency. These trends will redefine how businesses handle transactions and protect their interests.

Blockchain Integration

Blockchain technology is set to transform escrow account software. It offers a decentralized way to record transactions, providing increased security and transparency.

Here are some benefits of blockchain integration:

- Enhanced Security: Each transaction is encrypted and linked to the previous one, making it tamper-proof.

- Transparency: All parties can view the transaction history, fostering trust.

- Speed: Blockchain eliminates the need for intermediaries, speeding up the process.

- Cost Efficiency: Reduces costs associated with third-party verification.

The table below summarizes the advantages of blockchain integration in escrow software:

| Feature | Benefit |

|---|---|

| Security | Data is encrypted and immutable |

| Transparency | Open transaction history |

| Speed | Faster transactions |

| Cost | Lower fees |

Blockchain’s integration into escrow software is inevitable. It aligns with the industry’s need for secure, transparent, and efficient solutions.

Ai And Automation

Artificial Intelligence (AI) and automation are also shaping the future of escrow account software. These technologies streamline operations, making them more efficient and less prone to human error.

Key benefits of AI and automation include:

- Efficiency: Automates routine tasks, saving time and effort.

- Accuracy: Reduces human error in transaction processing.

- 24/7 Operation: Provides round-the-clock service without the need for human intervention.

- Personalization: AI can tailor services to meet individual client needs.

The table below highlights the benefits of AI and automation in escrow software:

| Feature | Benefit |

|---|---|

| Efficiency | Automates tasks |

| Accuracy | Minimizes errors |

| 24/7 Operation | Continuous service |

| Personalization | Customizes experiences |

AI and automation will continue to evolve. They will drive the development of more sophisticated escrow software solutions. This evolution will enhance the user experience and operational efficiency.

Frequently Asked Questions

What Is Escrow Account Software?

Escrow account software manages and automates secure transactions between buyers and sellers. It ensures funds are safely held until conditions are met.

How Does Escrow Software Work?

Escrow software holds funds until transaction terms are met. It releases funds upon confirmation from both parties, ensuring secure and transparent transactions.

Why Use Escrow Account Software?

Using escrow account software ensures secure transactions, prevents fraud, and provides peace of mind for both buyers and sellers.

Can Escrow Software Be Integrated?

Yes, escrow software can be integrated with various platforms. This integration streamlines transaction processes and improves business efficiency.

Conclusion

Choosing the right escrow account software makes a big difference. It ensures secure transactions and simplifies complex processes. Businesses save time and reduce risks, and customers feel more confident. So, investing in reliable escrow software is wise. It helps manage funds efficiently.

Plus, it enhances trust between parties. In the end, secure and smooth transactions benefit everyone involved. Consider your options carefully. Make the best choice for your needs. Your business will thank you.