Managing finances is not an easy task, especially for small businesses or consultants who have no dedicated finance team. Financial Fusion Lifetime Deal is an easy-to-use, AI-enabled application that will assist you in understanding your financial data, generating reports, and making more informed decisions.

With its lifetime deal, you pay once and get lifetime access to all of its features. So what is Financial Fusion, its advantages, its cost and why is it right for your business?

What is Financial Fusion

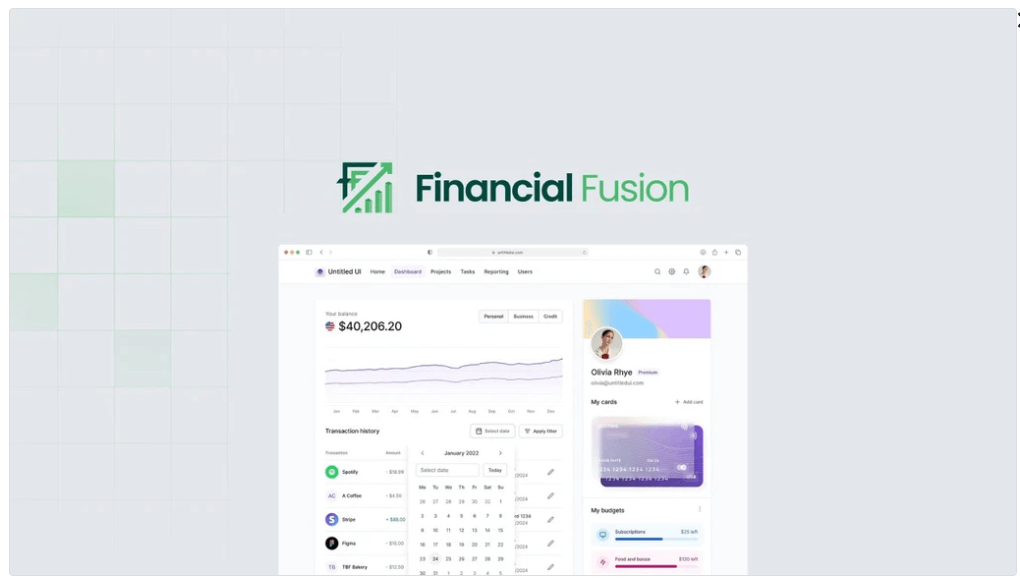

What is the financial fusion tool? It employs AI technology to analyze your financial data and convert it into straightforward, easy-to-read reports.

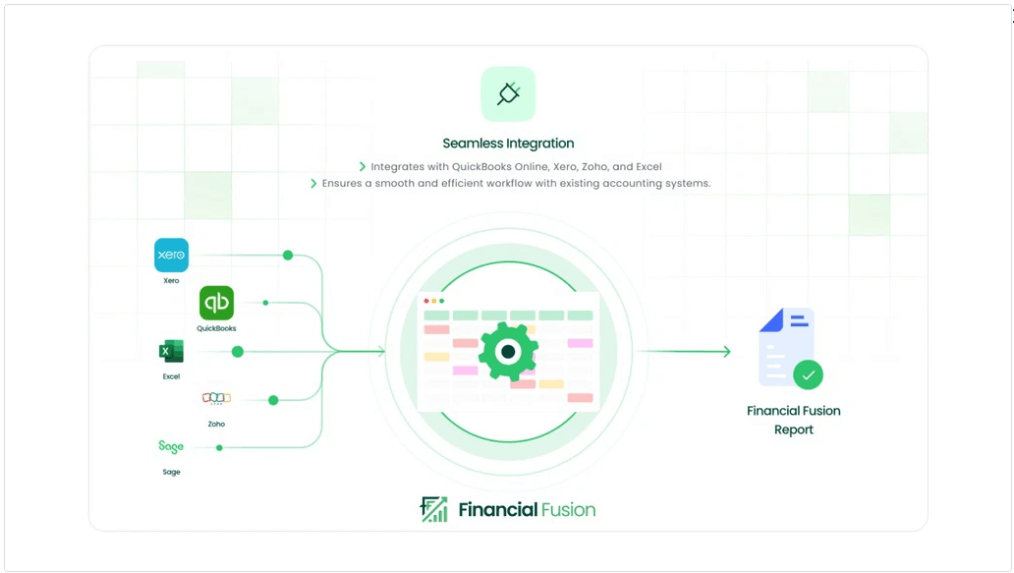

Finance and Your Fingertips is ideal for small business owners, consultants, and professionals tired of spending hours researching how to improve their bottom line but still wanting the service of an accounting professional even if they are not an accounting professional. It also integrates with tools such as QuickBooks, Xero, and Shopify, so all the financial data is in one place.

For other software to optimize your business processes, Take a look at Billed Lifetime Deal, Which offers a consummation to help you manage your finances.

Features

| Feature | Description |

|---|---|

| AI-Powered Insights | Automatically analyzes your data and provides helpful tips to improve finances. |

| Customizable Reports | Create reports like profit and loss, balance sheets, and yearly reviews. |

| Tool Integrations | Works with QuickBooks, Xero, Shopify, Excel, and more. |

| Real-Time Updates | Keeps your financial data updated instantly. |

| Lifetime Deal | Pay once and use it forever—no monthly fees. |

These features are designed to save you time and help you focus on growing your business.

Pros & Cons

Pros

- Cost-effective: Paid once, access forever.

- Easy to use: You do not need advanced accounting knowledge.

- Time-saving: Generates professional reports in no time

- Integrations: Syncs with common tools such as QuickBooks and Shopify.

- What You Already Know About This Tool: AI Insights: Alerts you to trends that will improve your decision-making.

Cons

- Some more advanced features (like cash flow tracking) are in development.

- Reporting options are limited on lower-tier plans.

- It doesn’t supplant bookkeeping tools such as QuickBooks — it integrates with them.

Personal Experience

Financial Fusion is something I’ve been using for several months and has simplified the way I handle my business finances. I would spend hours making reports old school. Yes, I can create detailed reports with a few clicks now.

AI-powered insights are among the most helpful features. It flagged areas where I was overspending, for example, which helped me control my costs and save money. Plus, the tool integrates seamlessly with QuickBooks, eliminating my need to manually transfer data.

In general, it has been an excellent investment for my business.

Pricing

Financial Fusion Lifetime Deal — Pricing Plans:

| Plan | Price | Features |

|---|---|---|

| License Tier 1 | $29 | 1 company, basic reports (profit and loss, month-end reports). |

| License Tier 2 | $99 | 1 company, detailed reports (balance sheets, quarterly/yearly reviews). |

| License Tier 3 | $199 | 5 companies, all features from Tier 2. |

All plans include a 60-day money-back guarantee, so you can try it risk-free.

Alternatives

If Financial Fusion doesn’t meet your needs, here are a few other tools you can consider:

| Tool | Best For | Drawbacks |

|---|---|---|

| QuickBooks | Bookkeeping and daily transaction tracking. | Doesn’t offer advanced insights or customizable reports. |

| Zoho Books | Affordable bookkeeping for small businesses. | Limited features compared to Financial Fusion. |

| Tableau | Data visualization and analytics. | Expensive and requires technical skills to use effectively. |

These tools are great, however, this tool trumps it all with its AI insights, personalized reports, and one-time payment.

For more information on how to level up your productivity using tools, read our How Zoho Boosts Productivity to get examples of how to save time and improve business efficiency.

Why Choose the Financial Fusion lifetime deal?

Here is why you should choose Financial Fusion:

- Saves time: Automates financial reporting, allowing you to refocus on your business operations.

- Passive Income: You pay once and get lifetime access. Monthly subscriptions are much more expensive.

- Intuitive: Built for users with no or low accounting knowledge.

- Syncs with QuickBooks, Excel, Shopify etc: Integrates with Popular Tools

- Regularly Updated: The tool continues to optimize over time; the updates are frequent.

If you are looking for other tools to grow your business online, you may want to read our article on Online Tools Grow a Business.

Conclusion

Financial Fusion as its name suggests is one of the simplest and most economical tools to manage money. Ideal for small businesses, consultants, and professionals looking to save time and improve decision-making, with its AI-powered insights, customizable reports, and seamless integrations.

This lifetime deal is an excellent opportunity to get your hands on a tool that can scale with your business. If you need to make your financial management efficient, Financial Fusion could be what you’re looking for. is worth considering.