If you are drowning in debt, it can feel stressful and confusing. But the good news is, you do not have to do it alone. CuraDebt is a company that helps people get relief from their debts. The best part? Signing up for their services takes just a few minutes.

In this guide, I will walk you through the steps to sign up for CuraDebt debt relief services. I will also share some useful tips to simplify and stress-free the process.

Let’s get started!

What Is CuraDebt and Why Should You Use It?

CuraDebt is a company that helps people manage and reduce their debts. They specialize in helping with different types of debt:

- Credit card debt

- Tax debt

- Personal loans

- Medical bills

The company works with your creditors (the people you owe money to) and negotiates to lower your total debt. Instead of paying the full amount, you might end up paying only a part of it.

Why Choose CuraDebt?

Here are three reasons why CuraDebt is a good option:

- It’s Fast and Easy: You can sign up quickly. No long forms or confusing steps.

- Free Consultation: You can talk to their team for free before you decide.

- Trusted Service: CuraDebt has helped many people reduce their debts for over 20 years.

If you want a simple way to get your debt under control, CuraDebt is worth trying.

Step-by-Step Guide to Signing Up for CuraDebt

Signing up for CuraDebt takes just a few minutes. Here’s how you can do it:

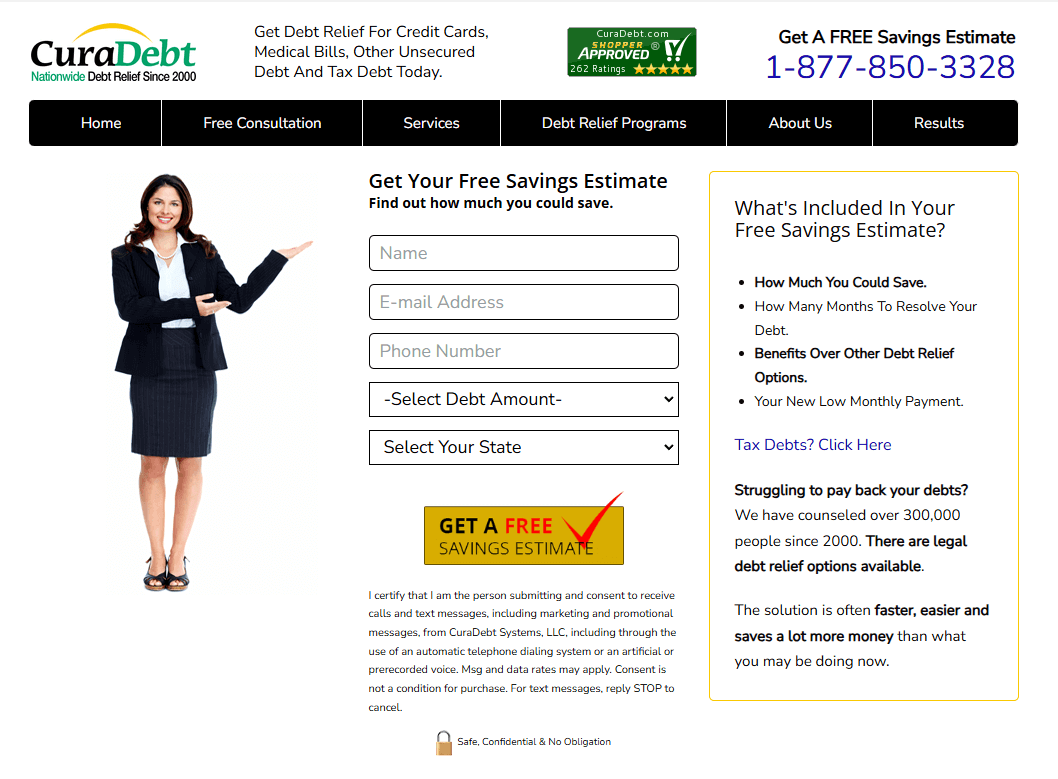

Step 1: Go to the CuraDebt Website

First, visit the CuraDebt website. The website is easy to use, and you will find all the information you need.

- Type “CuraDebt” into Google.

- Click on the official CuraDebt link (usually the first result).

- Once you are on the homepage, you will see a button that says “Get a Free Consultation.”

Step 2: Fill Out the Short Form

After clicking on the “Free Consultation” button, you will see a short form. This form asks for basic information. Don’t worry, it’s simple and quick.

You will need to enter:

- Your name

- Your phone number

- Your email address

- How much debt you owe (an estimate is fine)

Step 3: Submit the Form

Once you fill in the form, click the “Submit” button. CuraDebt will review your details and contact you shortly.

What Happens Next? (The Free Consultation)

After you submit the form, a CuraDebt representative will call you. This is a free consultation, so you don’t need to pay anything. The call usually takes 15 to 30 minutes.

What Will They Ask?

During the call, they will ask you a few simple questions:

- How much debt do you have? (Approximate amount)

- What type of debt is it? (Credit card, tax debt, etc.)

- What is your monthly income?

- What are your current expenses?

This information helps them understand your situation and find the best solution for you.

Tips to Make the Process Faster

Here are a few tips to make signing up for CuraDebt even quicker:

- Know Your Debt Amount: Have a rough idea of how much money you owe.

- Keep Your Phone Nearby: CuraDebt will call you shortly after you submit the form. Be ready to answer.

- Ask Questions: If you don’t understand something, ask. Their team is there to help you.

Why the Sign-Up Process Is So Simple

Many people avoid debt relief because they think it will be complicated. But CuraDebt has made the process very simple. They know you are already under stress, so they do not ask for too much information upfront.

The first form only takes 2 minutes to complete. And the phone call is quick, friendly, and free.

What You Don’t Need to Worry About

- You don’t need to provide your Social Security Number when signing up.

- You don’t need to pay anything to start the process.

- You don’t need to commit right away.

Common Mistakes to Avoid

Here are some mistakes people make when signing up for debt relief:

- Not Answering the Phone: CuraDebt will try to call you quickly. If you miss the call, you might have to wait longer for help.

- Guessing Your Debt Amount: Try to give an accurate estimate of how much you owe. It helps them create a better plan for you.

- Being Afraid to Ask Questions: It’s okay if you don’t understand something. Ask! CuraDebt’s team is there to explain everything.

Quick Comparison Table for CuraDebt Sign-Up Steps

| Step | What to Do | How Long It Takes |

|---|---|---|

| Step 1 | Go to the CuraDebt website | 1 minute |

| Step 2 | Fill out the short form | 2 minutes |

| Step 3 | Submit the form | 1 minute |

| Step 4 | Wait for a free consultation call | Within 24 hours |

What Happens After the Free Consultation?

Once you complete your free consultation, CuraDebt will create a custom plan for you. This plan is designed to help you pay off your debt in a manageable way.

How Does the Plan Work?

- Negotiation: CuraDebt talks to your creditors to reduce the total amount you owe. For example, if you owe $10,000, they might negotiate it down to $6,000.

- Affordable Payments: They help you set up smaller, monthly payments that fit your budget. This makes it easier to pay off your debt without stress.

- Timeline: The team will give you a clear timeline for when you can expect to be debt-free.

Why This Plan Works

CuraDebt’s team is experienced in dealing with creditors. They know how to negotiate for lower amounts. They also focus on creating a plan that fits your income and expenses, so you don’t feel overwhelmed.

Success Stories: Real People, Real Results

Many people have used CuraDebt to reduce their debts. Here are a few examples:

- John, California: “I had $15,000 in credit card debt. CuraDebt helped me settle it for $8,000. The process was smooth and stress-free.”

- Maria, Florida: “I was struggling with tax debt. CuraDebt not only reduced the amount I owed but also set up a plan I could afford.”

- Ahmed, Texas: “At first, I was unsure. But CuraDebt’s free consultation helped me understand my options. I feel so much better now.”

These are just a few examples of how CuraDebt has changed people’s lives.

Conclusion

Getting started with CuraDebt is easier than you might think. The process is designed to be simple, stress-free, and fast. With just a few minutes of your time, you can begin the journey toward financial freedom. CuraDebt’s experienced team will guide you every step of the way, ensuring you have the support and information you need to succeed.

If you’re ready to take control of your financial situation, don’t wait. Start today and see how CuraDebt can help you create a brighter, debt-free future.

Frequently Asked Questions (FAQs)

1. Is CuraDebt free to start?

Yes, signing up and the first consultation is completely free.

2. What types of debt does CuraDebt handle?

CuraDebt handles credit card debt, tax debt, personal loans, medical bills, and more.

3. How long does the consultation call take?

The call usually takes between 15 to 30 minutes.

4. Will CuraDebt hurt my credit score?

Debt relief can affect your credit score temporarily, but paying off your debt can improve it in the long run.

5. How soon can I see results?

Many people start seeing progress within a few months after CuraDebt begins working with creditors.